marketlan/iStock via Getty Images

Investment thesis: Last year was a horrible year for Europe’s economy. It experienced near zero economic growth for all of 2023, and this year seems to bring more of the same. The IMF recently lowered its projections for the EU, and I am sure more downward revisions are coming. There is simply nothing to drive the EU economy forward. Things might look even worse if it were not for warmer winters, ironically arguably due to climate change, which helped Europe to drastically reduce natural gas consumption since 2022, thus avoiding the risk of having to disrupt and further destroy industrial demand.

Aside from being helped to dodge a major energy crisis thanks to the environmental emergency that the EU sacrificed its economy to fight, there is no silver lining, only further institutionalized competitive disadvantages that are set to continue weighing Europe’s economy down, to the point where the economy is no longer delivering, and we see the resulting discontent increasingly pouring out on to the streets.

The potential risk to investors includes a hit on European stock investments, as well as the potential for an impact on companies outside of the EU that have significant exposure to the European market. In a worst-case scenario growing discontent and other factors can lead to the EU plunging into a severe socioeconomic crisis, with potential global economic consequences.

The state of the EU economy

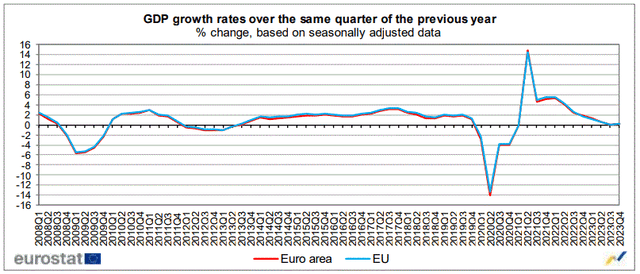

- Economic growth is almost non-existent.

Eurostat

As we can see, the last few quarters have seen very little growth compared with the same quarters from the previous year. In other words, the EU economy keeps decelerating. One of the key contributing factors is the decline in industrial output that started in 2022 and seems to just keep heading in the same direction.

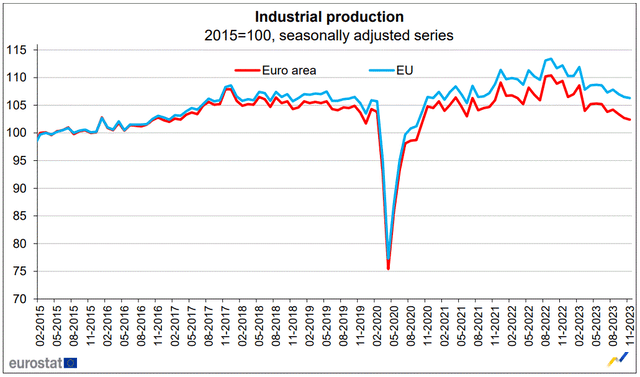

Eurostat

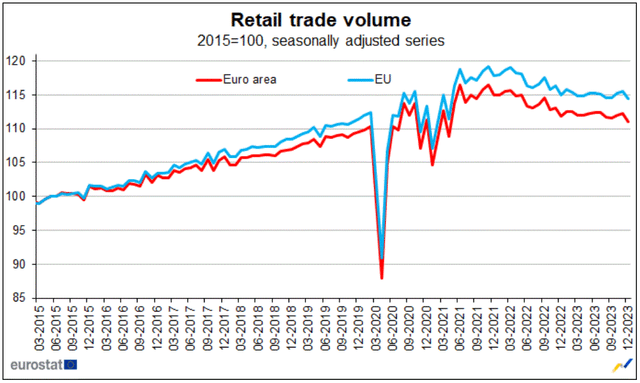

Industrial production in the euro area is now below the end-of-2019 levels and it is approaching lows not seen since 2015. Other metrics such as retail sales confirm a similar trend of economic deceleration that coincides with the start of the war in Ukraine. However, this is by no means Europe’s only problem, dragging its economy down toward stagnation and potentially toward a breaking point.

- The decades-old fight against climate change is the main impediment to the EU economy.

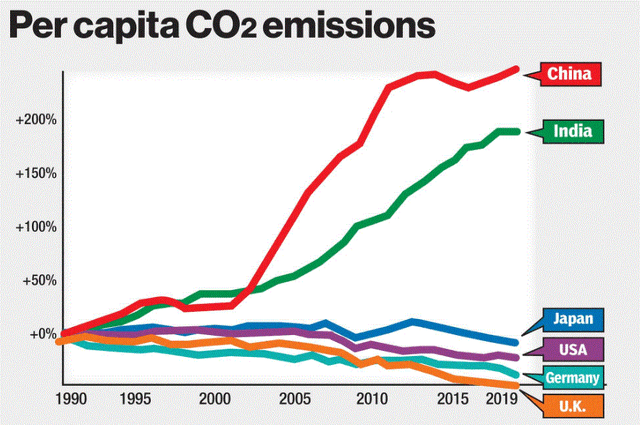

Politifact

As the chart shows, European countries have been far more aggressive in tackling CO2 emissions compared with most other major economies. The EU just adopted a far more ambitious target of cutting emissions to 90% below 1990 levels by 2040. In other words, the EU intends to cut twice as much as it did between 2022-2040, as it did between 1990-2022. Not to mention that the first stage involved harvesting the low-hanging fruit.

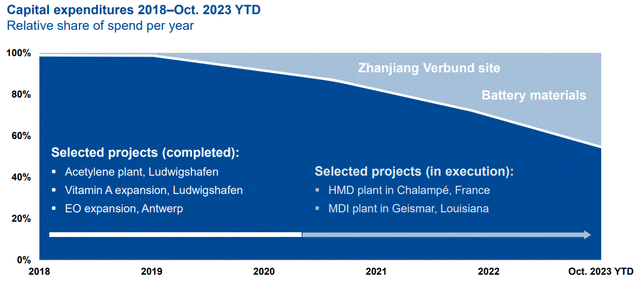

With such policies in place, it is understandable why there is a widespread lack of interest in investing in EU industrial capacities. BASF (OTCQX:BASFY) for instance, which I see as a company that can serve as a good proxy for the overall European industrial situation, intends to invest mostly outside of the EU, with capital investments in Europe winding down, even as it is ramping up its investment in China.

BASF

Not only does BASF not invest in new European operations, but it is cutting back on capacity and capacity utilization in existing ones. The main culprit seems to be the natural gas price shock triggered by the Ukraine war and the resulting fallout. Europe’s industries have been struggling for many years before the latest hit emanating from the Ukraine war, mostly due to the rising costs of dealing with emissions reduction demands, which puts them at a significant competitive disadvantage compared with peers from other regions.

- The EU had to drastically cut natural gas consumption following the heating up of the Ukraine war in 2022.

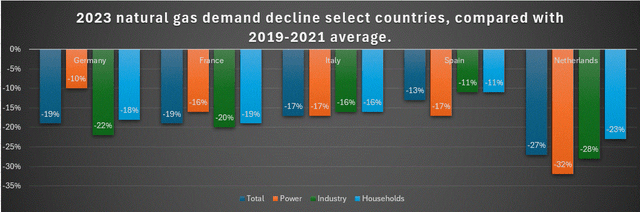

Data source: Bruegel

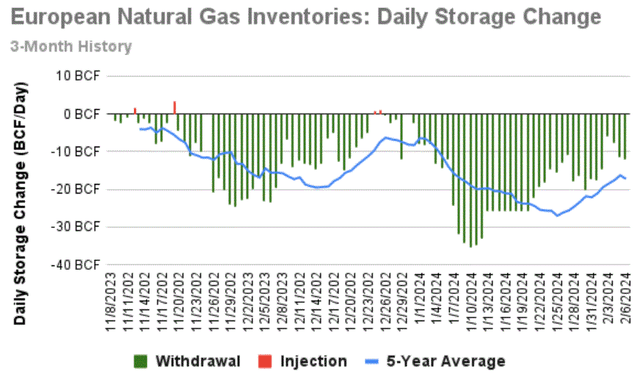

As we can see, natural gas consumption in the EU’s largest economies declined dramatically in 2023 compared with the pre-Ukraine war averages of the 2019-2021 period. All sectors had to participate to make up for the net loss in supplies caused by the EU’s efforts to end its dependence on Russian natural gas. What made it easier for households to participate has been a string of mild winters in the past few years. The 2022-2023 winter was considered to be the second-warmest on record. The current winter seems to be largely a repeat of last year, with only two brief cold spells causing an above-average daily drawdown of inventories for the entire winter. To be clear, those cold spells were by no means out of the ordinary, but rather just a return to longer-term average temperatures.

Celsius Energy

It should be noted that mild winters and reduced industrial and power use are not the only mechanisms that are at work in reducing natural gas demand in Europe. The rise in household energy costs in the EU led to a pricing-out mechanism for poorer consumers. Even within the context of these mild winters, Europe’s growing ranks of the working poor are increasingly turning down the thermostat. In 2021 under 7% of EU households could not afford adequate heating. In 2022 that figure jumped to 9.3%, due to the shock of the Ukraine war. Based on my interactions with my European contacts, friends, and relatives, the situation may have worsened compared with 2022 for many households. The practice of turning the thermostat down below ideal comfort levels to avoid racking up unaffordable utility bills has become widespread, despite the winters being warmer than longer-term historical norms.

It should be noted that the rising rate of working household poverty, and the rising rate of households struggling to afford utility bills is a sure sign that the EU consumer is in deep trouble, which is also reflected in retail sales data.

Eurostat

It is perhaps somewhat ironic that EU leaders are so obsessed with fighting climate change that they are willing to harm the economy. I don’t believe that it could survive beyond two or three normal winters in a row.

The EU economy is limping & prospects look bleak

- EU industries lack a path to recovery.

As I highlighted already, using the example of BASF as a proxy for the wider EU industrial base, there is precious little incentive to invest in Europe, aside from some niche markets, such as EV-related investments, which I covered in a recent article. The emissions-cutting screws are being tightened, arguably to a level that makes it unsustainable, based on the EU’s newly-agreed 2040 plan, as well as other plans in place, such as ending ICE-powered car sales by 2035. As we saw recently, farmers already had their revolt, leading to the EU backing down from further painful measures that European farmers are desperate to try to avoid as a matter of survival for a growing number of farming establishments.

While the farmers managed to stem some of the ruinous measures in the EU legislative pipeline, most of the rest of the major EU industrial sectors are unlikely to manage a similar feat. As I pointed out in an article in 2022, the EU ICE ban is likely to decimate the already embattled EU car industry. Faced with a choice of buying EVs that do not meet practical range needs and giving up on driving, many EU consumers will do the latter. The petrochemical and other major industries such as the metallurgical sector are facing the prospect of permanently higher and volatile natural gas prices. The recent US decision to halt LNG expansion, even as Russia is decidedly looking to Asia as its main future market, puts the EU in a risky position, where economic tragedy will always be perhaps just one or two normal winters away.

The EU is increasingly aware of the risks to its industrial base posed by emissions-cutting policies as well as its precarious position in terms of energy security, which is why it is increasingly mulling protective trade barriers meant to even the playing field. The potential economic blowback from many of its trading partners is potentially more harmful than the competitive disadvantages that its climate policies are imposing on its industry. For instance, China might retaliate by restricting trade and curtailing the activities of European companies that manufacture and sell goods in China.

The emergence of the issue of energy security might have been the last nail in the coffin for industrial capital investment prospects. Even current infrastructures are in danger of disappearing, as the BASF example shows. A survey of industrial companies in Germany released last fall shows that two-thirds of German companies already decided to move manufacturing activities out of Germany largely in response to high energy prices

The EU needs new, reliable, predictable natural gas supplies to make up for the Russian loss. America’s recent decision to halt new LNG projects may have killed any chance that the EU may have had of restoring some semblance of energy security. Between the rising costs of complying with emissions targets, the destruction of Europe’s energy security, as well as other factors such as rising trade issues, and global supply chain disruptions, the EU’s prospects for reversing the current decline in industrial activities look bleak, and with that the prospects of European industrials stocks look bleak as well.

- EU consumers are suffering.

From the end of 2019 to the end of 2022 real wages in most EU countries experienced a decline. Notably, France’s real wages increased by 1.5% for the period. However, most other major EU economies saw a significant decline. Germany’s real wages declined by 3.2%, Spain’s by 4%, Netherlands’s by 7.4%, and Italy’s by 7.5%.

The net effect of the decline in the real buying power of European consumers is seen in retail sales, which I already cited. It is also seen out on the streets, with the past decade providing ample evidence of widespread public discontent, most often triggered by the increasingly heavy burden of climate initiatives. The Yellow Vest protests provided the first signs of mass discontent over environmental policy costs some years back. The latest sign of discontent emerged as a widespread farmer revolt spread to pretty much every country in the EU in the last few months. The only thing that is most likely preventing mass protests over utility costs, especially in winter has been the fact that the last few winters have been warm by longer-term historical standards. Based on the feedback I have been getting from my various European contacts, it would not take much of a further increase in household and natural gas prices or consumption volumes due to cold weather to cause a public revolt.

- The collapse and disintegration of the EU is an increasingly realistic worst-case scenario, and it could reach a breaking point suddenly, at any moment.

The many crisis events that the EU muddled through in the past decade and a half, paradoxically led to a widespread assumption that the EU is resilient and able to withstand challenges. An entity that is in constant crisis is by definition the opposite of resilient. It is in constant danger of failure. The resilience thesis is therefore flawed in my view.

The definition of collapse can take on various meanings. It need not involve the institutional collapse of the EU. It can mean the collapse of the EU, or it could mean a sudden or gradual economic deterioration, with a permanent feel to it, meaning that it cannot be reversed. I believe that we are already in the gradual economic deterioration phase, as evidenced by the metrics I explored in the article. This initial phase that is already underway can in turn trigger the other two phases.

The growing public dissatisfaction could lead to an outcome in the upcoming EU elections in a few months that can potentially paralyze it institutionally. An unusually cold spell in the next few months, which is increasingly unlikely to happen, or a repeat of the 2021 shortfall in renewable energy production could also trigger an accelerated path to collapse. Perhaps, a further deterioration in the global geopolitical landscape, with a trade war between the EU & China breaking out, with China potentially responding in an unusually aggressive manner is also a potential candidate that could serve as a crisis trigger. There is no telling what the trigger event might be, but the one thing that we can ascertain is that the list seems endless.

Conclusions:

- EU-related investments remain a high-risk bet.

I have been downbeat on investment opportunities with significant European exposure for a while now.

Germany DAX index (Seeking Alpha)

Looking at Germany’s DAX index (DAX:IND), one might argue that I have been wrong to be so negative on Europe. It most certainly underperformed the S&P 500 (SPX), which gained about 85% for the same period. At the same time, a gain of over 50% over five years can hardly be considered to be disastrous.

The fact that European investments did not perform as poorly as I feared in the past few years, does not mean that they will continue to hold up well in the future. The way I see it, given the lack of its ability to move out of its constant crisis mode, the odds of a severe collapse in the EU economy and a resulting carnage in EU investments is inevitable, even though the timing of it is very hard to predict. The uncertainty is a valid reason to keep one’s direct as well as indirect exposure to the EU economy limited.

- My direct investment exposure to the EU remains limited.

My current direct exposure is limited to a small position in Nokia (NOK), which I am currently looking to unload as soon as an opportune exit point arises. I also have a small position in upstart green hydrogen producer Fusion Fuel (HTOO), which is a potentially high-risk/high-reward bet on the EU’s aggressive green energy transition policy, which among other things provides plenty of grants for startups.

- Examples of EU stocks to keep an eye on.

Just because I have a negative overall view of the EU economy, it does not mean that I am completely shunning the European investment scene. As I briefly mentioned already, the EU is undertaking an aggressive energy transition, which includes a proposed ban on ICE-powered vehicles by 2035. In this regard, I see luxury carmakers BMW (OTCPK:BMWYY) and Mercedes (OTCPK:MBGAF) as being potentially the least affected, whereas carmakers that cater more to the middle class such as Volkswagen (OTCPK:VLKAF) are set to potentially suffer as middle-class consumers will be faced with a choice of buying a city car, given that it is all the EV range they can afford, or opt to give up on owning a car altogether. Given the well-developed public transit systems in most towns, not owning a car is a very viable lifestyle choice, and I expect that the EV transition will translate into a significant decline in overall car sales in the coming years & decades. Within this context which I explored a while ago through my coverage of BMW when the ICE sales ban was announced, I am looking to potentially take advantage of a more favorable entry point for both BMW & Mercedes stocks.

- Favorable weather may not be enough to save the EU.

Even though I have a negative view of the European economy, there are still positive arguments to be made for some potential investment opportunities in Europe, including some that I pointed out as well as some that I overlooked. However, when the best thing that one can say about the EU economy is that the thing it has going right now is ironically the warmer winters that are supposedly caused by the very climate change trend that the EU is unilaterally sacrificing so much to fight, one cannot approach the European investment scene in any other way, except with extreme caution.

Given that the EU is the world’s third-largest economy behind the US & China, a severe economic crisis in that economy will most likely trigger a global crisis. Given that the US & China are not exactly on solid footing economically speaking either, it would not take much of an external shock for these economies to plunge into crisis as well. In my view, investors should be wise to keep a very close eye on the unfolding economic, social, and geopolitical situation in Europe. It remains the prime candidate of the three major economies to serve as the trigger for a major global economic crisis. The timing of it may be uncertain, but one thing I am increasingly certain of is that there are only so many crises it can withstand before that one crisis appears, from which it will not be able to recover and survive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.